1. Asset allocation

Research shows that this important first step accounts for the majority of variation in a portfolio’s return. You and your advisor work together to structure an allocation designed for the long term and with the potential to meet your objectives. And remember, diversification works over time, not all the time.

2. Portfolio Design

We conduct exhaustive research and leverage our extensive knowledge of the economic cycle to construct portfolios that we believe should perform consistently across asset classes and geographic regions.

3. Investment research and access

We have decades of experience performing rigorous investment research and oversight for our clients, supporting investors with an institutional quality investment process. Investments are carefully monitored and adhere to a disciplined process to enhance consistency and potentially provide lower volatility.

4. Portfolio construction

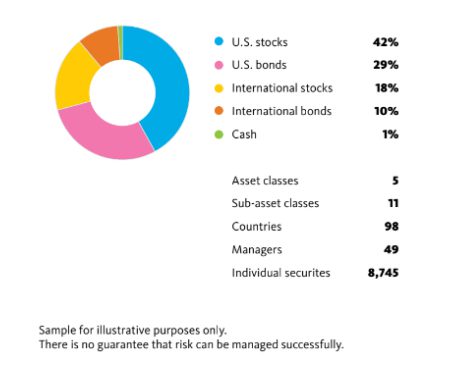

Our portfolios consist of multiple levels of diversification and are designed to optimize return while managing risk.

Our multidimensional approach to portfolio construction

- The top level includes a mix of asset classes like equities and income-generating securities such as bonds

- The second level consists of multiple sub-asset classes and styles, like large-cap stocks, small-cap stocks, growth, or value

- The third level demonstrates the geographic diversification of portfolios

- The fourth level represents the individual securities selected by the money managers for each portfolio

Then, all levels are continuously monitored and adjusted based on any changes in the markets or economy.

5. Tax management

Our investment process includes techniques designed to help you keep more of what you earn. Effective tax management can help protect wealth and maximize after-tax return. It’s not what you make, but what you keep.

6. Risk management

We commit significant resources to monitoring managers and investment strategies. Our Risk Management team is responsible for determining whether a portfolio’s risks are consistent with its given mandate. They report directly to the head of the Investment Management Unit (IMU)1, which helps preserve impartiality and enables immediate access to and support from senior management.